Modelling software for valuations & advisory

Forbury for Valuers

Use trusted methodologies to triangulate values for various asset classes.

Value with confidence

Reliably model an integrated assessment of value for freehold or leasehold commercial real estate assets. Suitable for any scale of asset and able to handle complex lease structures and sophisticated outgoings recoveries. Forbury's comprehensive input structure enables the granularity of outputs that you need.

Market Capitalisation

Flexible capitalisation at a single or blended (split yield) capitalisation rate.

- Make capital adjustments to the core capital value including allowances for imminent expiries, outstanding incentives and capex

- Capture up to 5 years' expiry allowances

Discounted Cashflow

Comprehensive DCF valuation assessment with 20-year cashflows by month and 10-year rolling DCF.

- Model tenant incentives using lump sum, rebates and rent-free structures

- Net or gross market rent data and incentive assumptions

- Specific lease renewal assumptions

- Input capex as allowances or by project

Direct Comparison

Assess value by comparing adjusted sales in the market of similar assets.

- Can be used alongside other methods to derive a midpoint between multiple valuation approaches.

Input

Enter property data in a way that suits your workflow:

- Some valuers save considerable time using the Import feature to upload tenancy data from PDF or Excel.

- Other valuers minimise their data entry by receiving a pre-populated model as a Forbury Share.

- We also know that sometimes entering your data cell-by-cell is important too.

Overlay

Your expertise and knowledge are put into practice when entering your assumptions into the model. You've got full freedom to tweak the settings as you need.

Additionally, the Houseviews feature allows you to store common assumptions for instant population into future models, and standardise these inputs across your organisation.

Review

Check the model for errors, and analyse insights to prepare your report.

- The risk of Excel is input errors. Forbury's smart Error Alerts notify you of any errors and take you directly to the affected cell.

- Analyse various scenarios and compare prior valuations with the Comparisons feature, to assess impact on the asset value.

- Collaborate easily with colleagues, and manage versions using Teams.

Present

Assumptions impact valuations and they won't always match your client's. Often, there is an involved discussion about the assumptions and value before a final valuation report is produced.

Take output sheets into another workbook with the Export tool, or use Sharing to directly and securely send the Forbury model to your client. Alternatively, produce bespoke ready-for-presentation reports with Custom, in your brand and style complete with outputs and commentary.

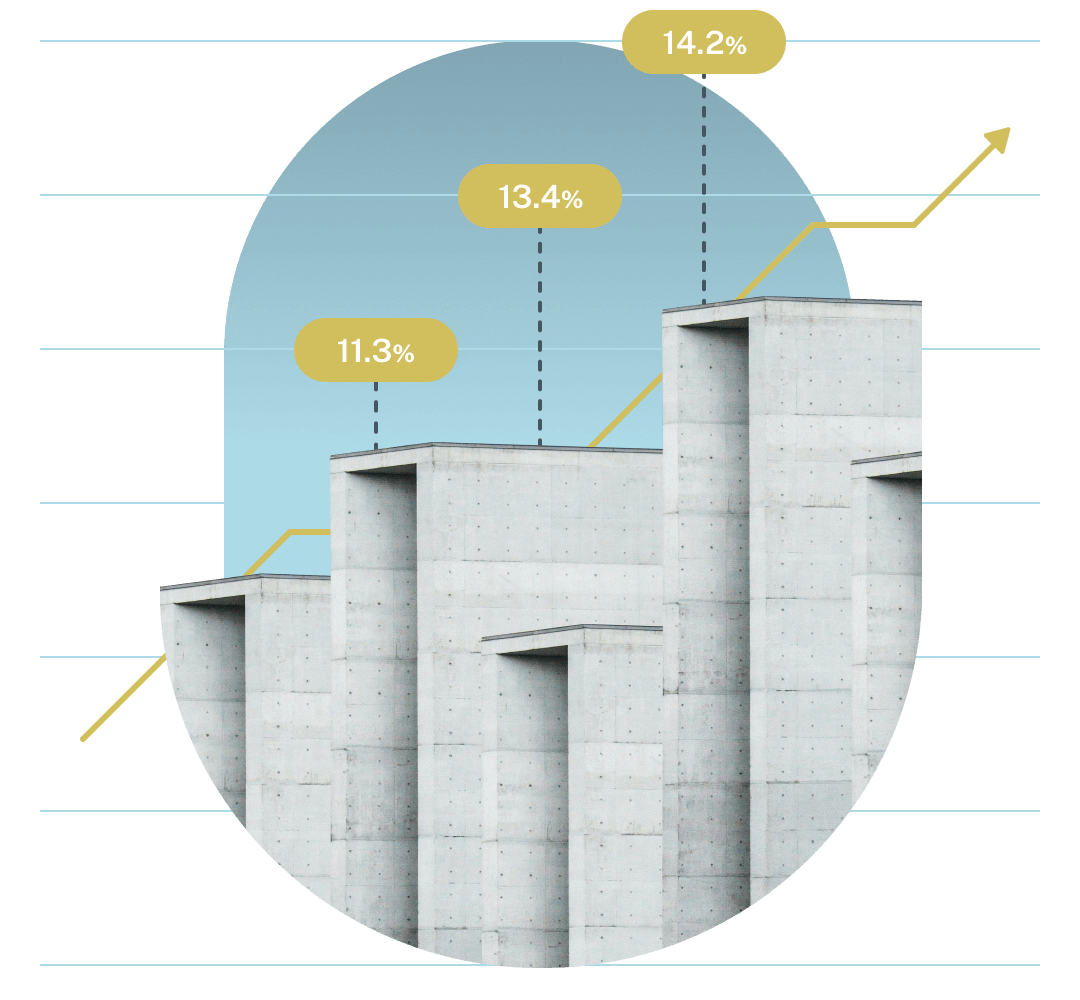

Streamline your valuation process

Move Clearly

Our Products are Excel-based, making it easy to trace and trust calculations. No more "black box solutions" no more doubt.

Move Precisely

Using thoroughly tested Australian-specific valuation methodologies, developed over 20 years. Trust your outputs implicitly.

Move Smarter

More valuations in less time, frees up your team to provide additional services to your clients.

Our Solutions

Forbury Commercial

Game-changing software for modelling office and industrial assets.

Forbury Retail

Ground-breaking software for modelling retail shopping centres.

Trusted by Valuers

We enjoy working with the Forbury team. They understand the intricacies of the Australian Commercial Real Estate market and have a great selection of talent. The Forbury products are intuitive, the logic-flow is easy to understand, and the outputs are accurate.

Jonathan Petsalis

Head of Office, Valuation & Advisory Services, Colliers Australia

Book a demo

Ready to transform your workflows?