Commercial Property Appraisal Software

Portfolio

Extend the power of Forbury and transform the appraisals process for complex portfolio modelling.

CRE software for Portfolio modelling

Used across the UK and Europe to provide an assessment of value and returns for a portfolio of properties.

Buy

- Assess acquisition opportunities quickly

- Overlay scenario analysis

- Assess the impact of finance scenarios

- Conduct valuation analysis

Manage

- Cashflow budgeting & valuation forecasting

- Assess leasing scenarios

- Generate Investment Management reports

- Conduct valuation analysis

Sell

- Assess divestment options

- Maximise value for sale

- Conduct Broker opinion of value

- Prepare marketing material

SPECIFICATION HIGHLIGHTS

Portfolio

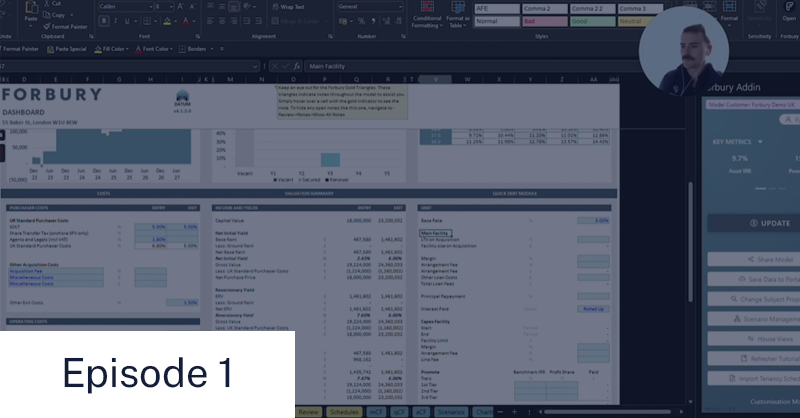

Provides a fast and intuitive assessment of multiple properties as a portfolio. Tested in-market and painstakingly developed over the years, it offers dynamic portfolio scenario analysis and allows immediate visibility of the impact of individual properties on portfolio returns. Portfolio eliminates the need to aggregate data from multiple sources, and can reduce time spent on financial modelling by up to 95%.

- Assess multiple assets within the same DCF model to build up to portfolio level returns and valuation.

- Change asset-level valuations across your entire portfolio within the same sheet.

- Apply portfolio-level leasing and growth assumptions to your chosen tenants.

- Interrogate cashflows from portfolio, asset, or tenant level within the same sheet.

- Sell assets at different time periods to review the impact on the portfolio.

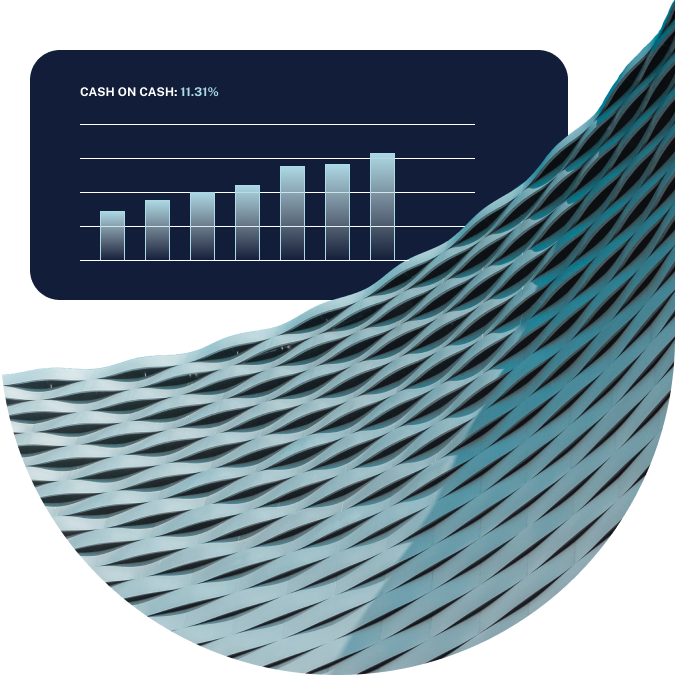

Lightning quick modelling

With an average calculation speed of 1.57 seconds, our cloud engine allows you to model assets at pace. Harness time-saving features to prepopulate your model with tenancy data and instantly apply in-house assumptions.

Minimise risk of expensive errors

Have confidence in the accuracy of your model with transparent and traceable calculation outputs. Collaborate effectively with clear integrity checks and version controls. Advanced error alerts notify you and take you to the source of the problem.

Tested and trusted

Built by financial modelling experts, the Forbury products are used globally by thousands of customers. Not only market-tested, our information security practices have passed the test too.

Our ISO/IEC 27001:2022 certification is testament to our commitment to ensuring customer data is secure, confidential and maintains its integrity.

What's Included

Automatically populate your model with tenancy information using the Import options which pull data instantly into your Forbury model from PDF, Excel, or ARGUS Enterprise file formats. Save yourself the time, hassle and risk of manually keying in the data.

Save time, minimise data entry and standardise inputs across your organisation. Populate your in-house assumptions (global views) and industry benchmarks into your models instantly.

Compare as many scenarios as you like within the same model. Quickly toggle through your scenarios to view the variances in key property metrics.

Build your own bespoke in-house sheets that can adapt to your unique business needs. Perform side calculations, additional data analysis, and augment reporting to match your brand and technical requirements. Your custom sheets are included in all future models, for effortless use across your organisation.

Assign your team into groups to effortlessly collaborate and share information within your organisation.

Frame additional funding structures, such as interest costs, management fees, management incentives and other dynamics; to understand geared and levered returns.

Advanced error alerts warn you of input errors and guide you on what needs to be fixed. With a single click, you’ll be taken directly to the cell with the error.

Get up to speed quickly with in-model tutorials, comprehensive support guides, webinars and options for additional training should you need it.

Here when you need us! From a pesky input error to modelling up a complex asset, the team are ready to help solve any issue.

The intuitive design allows us to turn around accurate appraisals with various scenarios and sensitivities faster. The Forbury team are very responsive to any queries, making it a highly valuable resource for our team.

Freddie MacColl

Partner - Capital Markets, Knight Frank

The team at Forbury have listened to what we were needing and have worked enthusiastically to meet our objectives in a friendly and helpful manner. The software is easy to use and intuitive and the support from the Forbury team throughout our journey with them so far has been first class.

Nick Penny

Head of Scotland, Savills

Portfolio is used with

Forbury

Designed for investors, brokers and advisors of commercial real estate to assess and maximise returns and value using UK and European appraisal methods.